These women are some of the leading figures in Europe’s VC scene and are making big steps to bring diversity to the fore of this male dominated field.

Kinga Stanislawska, Managing General Partner at Experior Venture Partners.

Kinga Stanislawska invests in deeptech startups at Experior Venture Partners and is working to raise women’s voices and profiles in the VC world. As founder of European Women in VC, a community of senior women investors, Stanislawska advocates for more diversity in the industry. She knows that diversity in VC is vital in ensuring funding is distributed to more diverse teams. A recent report found that:

‘All women-founded companies in [the CEE] received only 1% of the capital, while 5% went to mixed founding and 94% to all-male teams. At the same time, VC partners investing in the CEE region are predominantly men (93%), while women are heavily underrepresented counting for only 7%.’

Increasing diversity in the world of VC will be reflected in the teams receiving the capital.

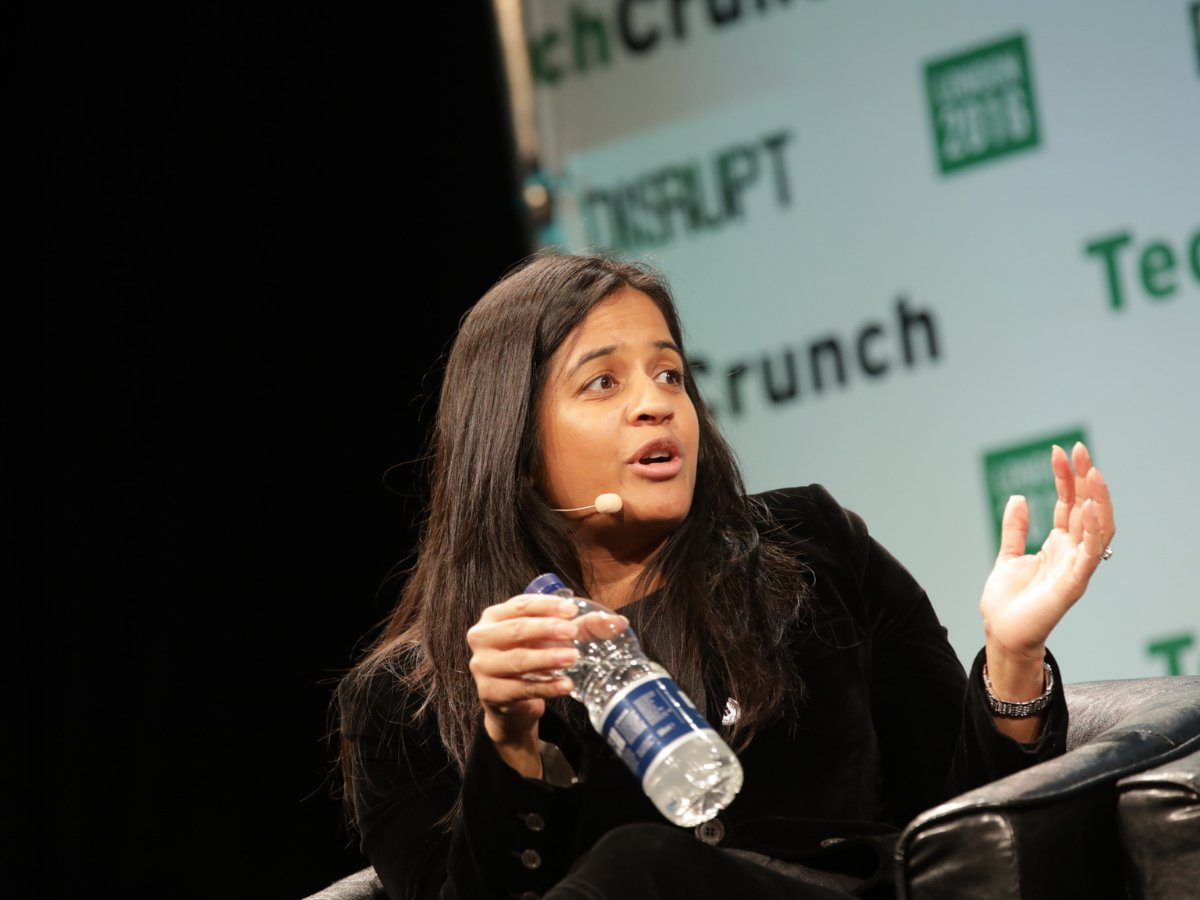

Reshma Sohoni, Managing Partner at Seedcamp

Reshma Sohoni founded Seedcamp in London in 2007 and in doing so ‘sowed the seeds of the European VC scene we know today.’ She was instrumental in the growth of Hopin, TransferWise, UiPath, Revolut, and many other well known startups across Europe. Sohoni is also very vocal about her experience as a woman in the VC industry, speaking out about the challenges of being both a mother and a highly successful VC. She is working to make this balancing act easier for others ‘not just internally at Seedcamp — where 40% of our team is a working mum — but through the companies we back.’

Marie Ekeland, Founder of 2050

Ekeland’s 2050 is focused on long-term impact, ‘shaping an economy aligned with the best interests of people, society and our planet’. The name highlights the longsightedness of their investments, focusing on startups that will be reaping the rewards of an equal and sustainable future for years to come.

‘It would be almost impossible to overstate Ekeland’s place in the French tech firmament. She co-founded France Digitale in 2012 to represent the nation’s entrepreneurs and VCs at a moment when many felt the government had turned decidedly against them.’

Her portfolio includes the likes of Criteo, arguably French Tech’s greatest success story. She aims to leverage diversity to foster the sharing of ideas and the creation of innovative solutions.

The incredible women behind V-Bio Ventures

Belgian firm V-Bio Ventures is working to achieve ‘global impact in effective healthcare & sustainable agriculture, by helping talented entrepreneurs/scientists set up exceptional companies.’ The team contains multiple spectacular women who could not be separated out or listed alone. Prior to founding V-Bio Ventures, Christina Takke spent over 15 years in European Venture Capital as a consultant, analyst and investment manager. She is joined by managing partners Shelley Margetson and Katja Rosenkranz, bringing a vast amount of experience to the table between them and forming a truly powerful team.

Heidi Lindvall, General Partner at Pale Blue Dot

Based in Malmo, Sweden, Heidi Lindvall’s climate tech VC firm Pale Blue Dot invests in companies that are working to ‘reverse climate change and prepare for a new world’. They invest in early stage companies across Europe and the US, proving ‘that investing in companies that have a positive climate impact is good for the bottom line — as well as the planet.’ Lindvall is also a documentary filmmaker with a background in Human Rights – a passion she has carried through into her investment practices.

Conny Hörl and Katja Ruhnke, CK Venture Capital GmbH

Using up two of our top ten slots here as it is impossible to mention only one of this powerful sibling duo. Both sisters see their minority position as women VCs a strength rather than a disadvantage and ‘are convinced that women will play a much more important role as investors in the future.’ The Munich-born pair’s investments vary from sustainable technology to video content production and AI support for radiologists. Their core principle is to invest in companies that help improve future outcomes for people and the planet.

Inka Mero, Managing Partner at Voima Ventures

Mero founded Helsinki based Voima Ventures in 2019. In doing so she became the first female founder and managing partner of a Nordic deeptech fund.

‘Mero is one of the best know people in the Finnish startup ecosystem. She has co-founded seven startups and invested in more than 20 startups as an angel investor in the past ten years.’

She got an early start in the VC world and was already managing the investments of the telecom company Sonera by the age of 24.

Bao-Y Van Cong, Investment Director for Target Global

Van Cong believes a lot of the changes we’ve seen during the pandemic are here to stay, from how we shop and order food to how we work – this is reflected in Target Global’s hunt for startups that link into these spaces. She ‘invests in European and Israeli early growth scale-ups, with more than $1.5 billion in assets under management.’

Van Cong is a strong advocate for increased diversity in the VC world:

‘Too often VCs subconsciously use biased signals for their decision-making that reiterates the status quo of white male successful founders. I am convinced that this is going to change with more and more women entering the venture capital space hand in hand with a greater consciousness for the benefit of diversity.’

Deepali Nangia, Venture Partner at Speedinvest

Ending the list with a bang: Deepali Nangia has invested in exclusively female founders across health, sustainability, fintech, women’s health, and many other areas. As the Co-Founder of Alma Angels (an angel community supporting female founders) Nangia is a vocal proponent for VC diversity. Alma Angels was founded because ‘less than 8% of investors and angels in Europe are women’ and they seek to change this by connecting and empowering women founders and investors.

Nangia is working to create a future where ‘diversity and inclusion will no longer be a category we spend time and effort on but will be commonplace.’

Recommended for you

Antidepressant Prescribing at Six-Year High

More people are taking antidepressants than ever. Is this a dark sign of the times or an indication that mental health stigma is changing?

Can AI be Used to Determine Cancer Recurrence?

When cancer patients go into remission, they often worry about it coming back. AI can now help identify those at risk of cancer recurrence.

Pegasus – Still a Threat to the UK?

The notorious Pegasus spyware has been misused to exploit vulnerabilities in devices, even those kept within the walls of Number 10.

Trending

Drug Decriminalisation: Could the UK Follow Portugal?

Portugal’s drug decriminalisation has reduced drug deaths and made people feel safe seeking support. Would the UK ever follow suit?

Calling All Unvaccinated UK Adults

With Covid cases rising, the NHS is urging the 3 million UK adults who remain unvaccinated to come forward.