South-Asian ride-hailing company Grab Holdings has reportedly been considering listing in the U.S via a Special Purpose Acquisition Company (SPAC). The company is expected to be valued at a staggering $54 billion, making it one of the most valuable Asian listings of the year. If the deal materialises in its present form, this would be the biggest ever blank-check transaction on Wall Street so far.

While Silicon Valley based tech-focused investment company Altimeter Capital Management has been the frontrunner for the deal so far, Grab disclosed that it has recently held meetings with other SPACs too. Altimeter currently has two SPACs under its portfolio- Altimeter Growth and Altimeter Growth 2. In early January, Reuters had published a report claiming Grab was looking to raise $2 billion or more with its U.S IPO that it had been planning to list via a SPAC merger. A similar report published by the news media site Bloomberg disclosed the banking partners that Grab had picked for the deal. An excerpt from the report read:

Morgan Stanley and JPMorgan Chase & Co. have been selected to work on a listing that could happen as soon as the second half of this year. More banks could be added and details of the offering could change as deliberations continue.

About Grab

Grab is a Singapore based tech giant that started as a ride-hailing service back in 2012. It then swiftly expanded within the market and started running food delivery services too. Grab’s already stellar sales were boosted further by the lockdown, making it the most valuable startup in South-East Asia (according to its current $16 billion valuation). Grab’s IPO considerations came after its plans to merge with Indonesian rival Gojek were cancelled. The latter startup went on to merge with local e-commerce giant PT Tokopedia instead.

This deal is believed to have fuelled Grab’s plan to list soon as it gave birth to a formidable competitor that is worth $18 billion and encompasses everything from ride-hailing and payments to online shopping and grocery delivery services. This threatens Grab’s position in Indonesia, one of its key markets.

Grab’s revenue grew by over 70% in 2020, as it bounced back from an initial setback caused by the pandemic. This impressive performance and massive scope for market domination in the future are the factors that lead to an astonishing increase in Grab’s valuation as it went from about $14 billion in January to over $54 billion in March. Grab has more or less refrained from making any indicative comments about the deal so far:

“The market is good and the business is doing better than before,” it said. “This should work well for public markets.”

Analysis of IPOs via SPACs

SPAC mergers in the U.S have been at an all time high lately. These “blank-check” companies have raised over $82 billion in 2020 alone and are expected to rake in more as the trend accelerates this year. SPACs are supposed to allow more privileges to the founders/ chairs of the companies that list through them as opposed to traditional, direct listings. This seems to have tipped a massive number of new up and coming IPOs in their favour.

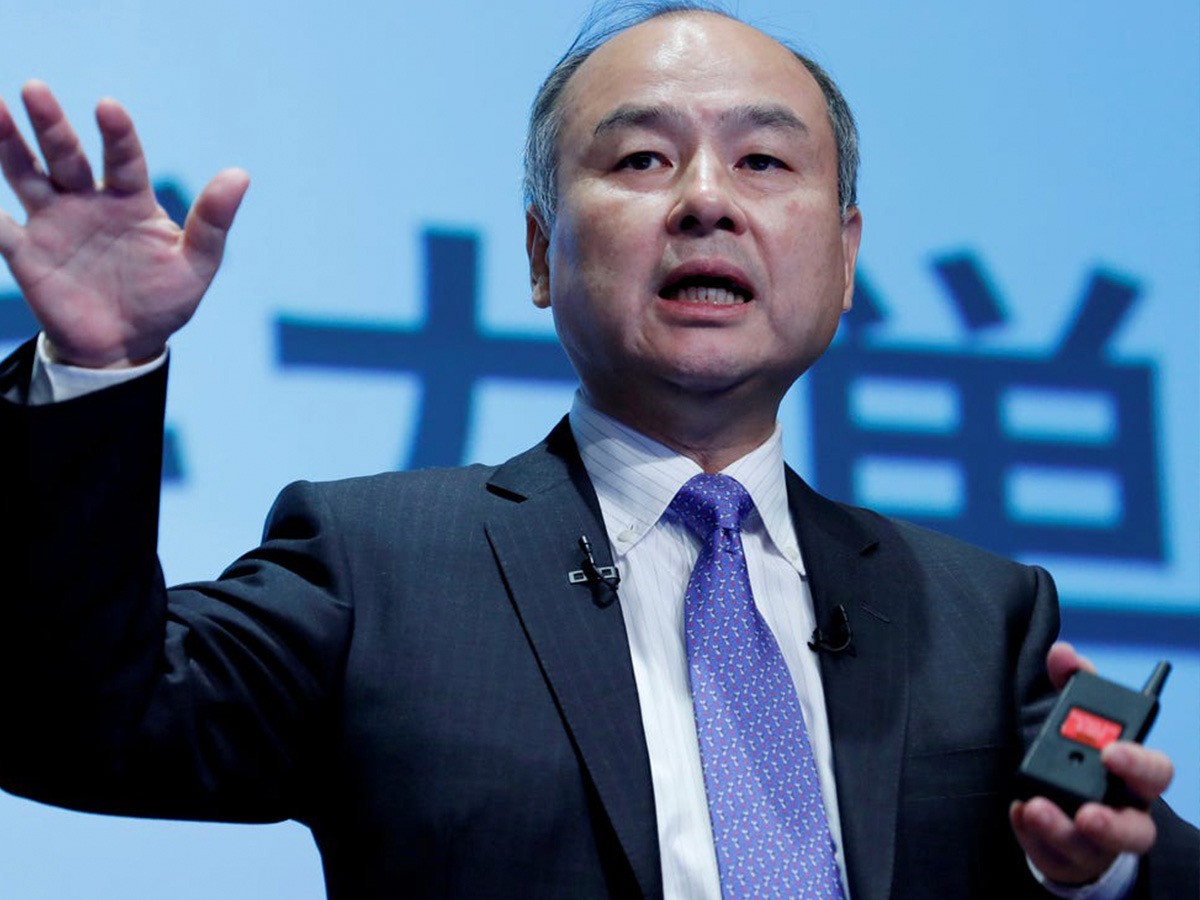

Some major SPAC transactions include UMW Holdings Corp’s $16-billion merger with a blank-check company that’s supported by billionaire Alec Gores and the $24-billion deal that luxury electric car manufacturer Lucid Motors entered with a Michael Klein-backed SPAC. As tech revenues continue to soar in 2021, more promising startups are expected to enter into these deals in the U.S. In the U.K too, the Ministry of Finance is expected to relax listing rules for SPACs at the LSE, in a bid to lure more European IPOs towards the city. As for SoftBank, after Coupang, Grab is all set to be another star company on its multibillion dollar portfolio. Grab Holdings is all set to strengthen this portfolio further as it is expected to have a blockbuster opening at the NYSE.

About the Author: Akshat Biyani

Akshat Biyani is a contributing Features Writer with extensive expertise in Business, Finance and Technology.

Recommended for you

What Does the Tory Leadership Battle Mean for the NHS?

As Truss and Sunak compete to become the new PM, one key topic is forming a noticeably small part of the Tory leadership debates.

Drug Decriminalisation: Could the UK Follow Portugal?

Portugal’s drug decriminalisation has reduced drug deaths and made people feel safe seeking support. Would the UK ever follow suit?

Trending

Drug Decriminalisation: Could the UK Follow Portugal?

Portugal’s drug decriminalisation has reduced drug deaths and made people feel safe seeking support. Would the UK ever follow suit?

Calling All Unvaccinated UK Adults

With Covid cases rising, the NHS is urging the 3 million UK adults who remain unvaccinated to come forward.